JEO 5 - JMoD Goes Shopping

A monthly news roundup and a deep-dive on the Japan Ministry of Defense (JMoD) space-related budget.

Welcome to Japan Earth Observer (JEO), a free monthly newsletter with a news roundup and one in-depth article about the space, Earth observation and geospatial industries in Japan. In addition to a news roundup, in this edition I’m also going to write a bit about some satellite infrastructure investments being planned by the Japan Ministry of Defense (JMoD). I was originally planning to write about open data this month, and I had the JMoD as a news item, but the length got out of hand, so I kept going. I’ll write about open data next month.

News & Announcements

💱 Contracts and Funding

-

Axelspace is planning an IPO on the Tokyo Stock Exchange [Reuters] as early as June. Government contracts in the form of the Space Strategy Fund and increased defense spending are enticing even loss-making private firms to consider public listings. Axelspace had previously considered a public listing, but delayed it in the face of equipment failures and delayed contracts. As such, this is probably the tail end of a two-year surge in public listings by private space firms - ispace, Synspective, iQPS, and Astroscale have IPO-ed since spring 2023 - rather than the start of a new phenomenon. Nonetheless, there is a general perception in Japan that its meager venture capital community and smaller domestic market drive a need to go public sooner than would otherwise be the case in North America or Europe. I’m a little skeptical of this oft-repeated justification, as Japanese firms potentially have the same access to the deep pockets of North American VC investors, but that’s the line I’ve frequently heard. In any event, Axelspace is planning to launch seven of its next generation GRUS-3 Earth observation satellites in 2026. In preparation for that, a GRUS-3α technology validation mission will be launched this summer on the SpaceX Transporter-14 rocket in June.

-

Synspective was awarded an imagery acquisition contract worth JPY 87 million (US $580,000) by the Ministry of Defense (JMoD) for FY2025 as well as a contract to develop security standard guidelines for space systems for the Air Self Defense Force (JASDF) worth JPY 99.99 million (US $665,000

-

SKY Perfect JSAT plans to invest JPY 70 billion (US $483 million) for ground stations, satellites, and other infrastructure in 2025 [Nikkei Asia], equivalent to the previous three years of investment, and then maintain that level of investment through 2027, as it shifts from a geostationary constellation to one that integrates LEO and High-Altitude Platform Stations (HAPS). The planned investment is driven by expected national security demand through 2030, and growing commercial demand in subsequent years.

-

Astroscale will be refueling two U.S. Space Force satellites [SpaceNews] in geostationary orbit in summer 2026. The refueling spacecraft, dubbed APS-R, will launch with a tank of hydrazine fuel that it will deliver to a Tetra-5 satellite just above the GEO orbital belt. Then it will back off and use a hyperspectral sensor to check for any leaks. Next, it will navigate to an Orbit Fab fuel depot, which will also launch in 2026, to refill and then head off to top up a second DoD satellite. The ASP-R satellite has a design life of two to three years so, Astroscale could potentially complete the U.S. Space Force contract and then go on to play fuel tanker to other satellites. This work will be funded by a $61 million OTA agreement with the Space Enterprise Consortium.

-

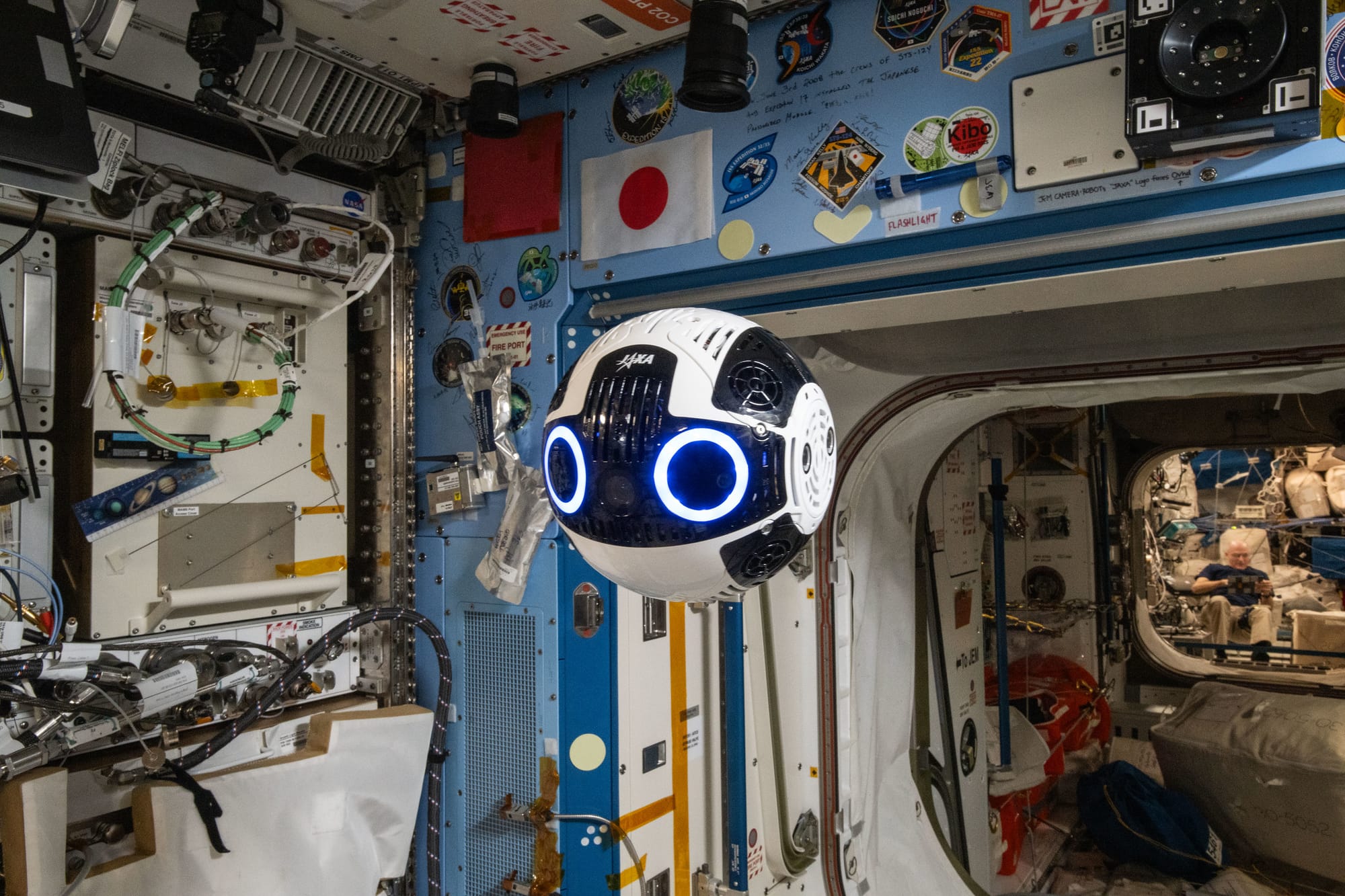

Japan Manned Space Systems Corporation (JAMSS) has signed an agreement with Vast to host a payload on the Haven-1 station [SpaceNews]. JAMSS has worked with JAXA to support research payloads on the ISS Kibo module, and aims to continue carrying out microgravity research after the ISS is deorbited in 2030. Haven-1 is expected to launch in mid-2026.

-

ispace signed an MOU with Australian nuclear engineering firm, entX, to assess the technical feasibility of integrating a Radioisotope Heating Unit (RHU) to enable survival of lunar nights. The collaboration will be partially supported by a grant from the South Australia government.

-

ispace also signed an agreement with KDDI for planning and research for a lunar mobile communications system. KDDI was awarded a Space Strategy Fund project in November 2024 to develop a high capacity Earth-Moon communication system.

-

A team led by the Institute of Science Tokyo and including ispace, Tokyo University, Hokkaido University, and Osaka Metro University has been awarded a JAXA Space Strategy Fund award for developing sensor technology for detecting water resources [JAXA] on the moon. This was the last of the Year 1 Strategy Fund topics and was a re-solicitation. The project will focus on detecting underground water using a terahertz wave remote sensing satellite.

-

Mitsubishi Bussan Aerospace, in partnership with Belgian firm, Aerospacelab, has been selected by JAXA to deliver a satellite [Satnews] for the Scanning Array for hyper-Multispectral RAdiowave Imaging (SAMRAI) mission.

-

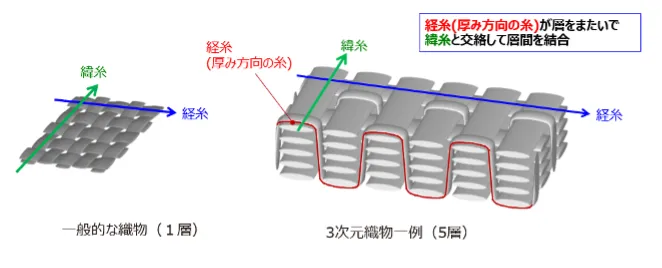

ElevationSpace and Toyota have signed an agreement to jointly develop heat-resistant materials for its ELS-R atmospheric re-entry vehicles. Toyota (which before its automobile business was a textile company) has been developing ”3D” textile technology using lightweight, heat-resistant carbon fiber for the automotive, aviation, and space industries.

Toyota 3D textile technology which includes the usual warp and weft plus a multi-layered “thickness” -

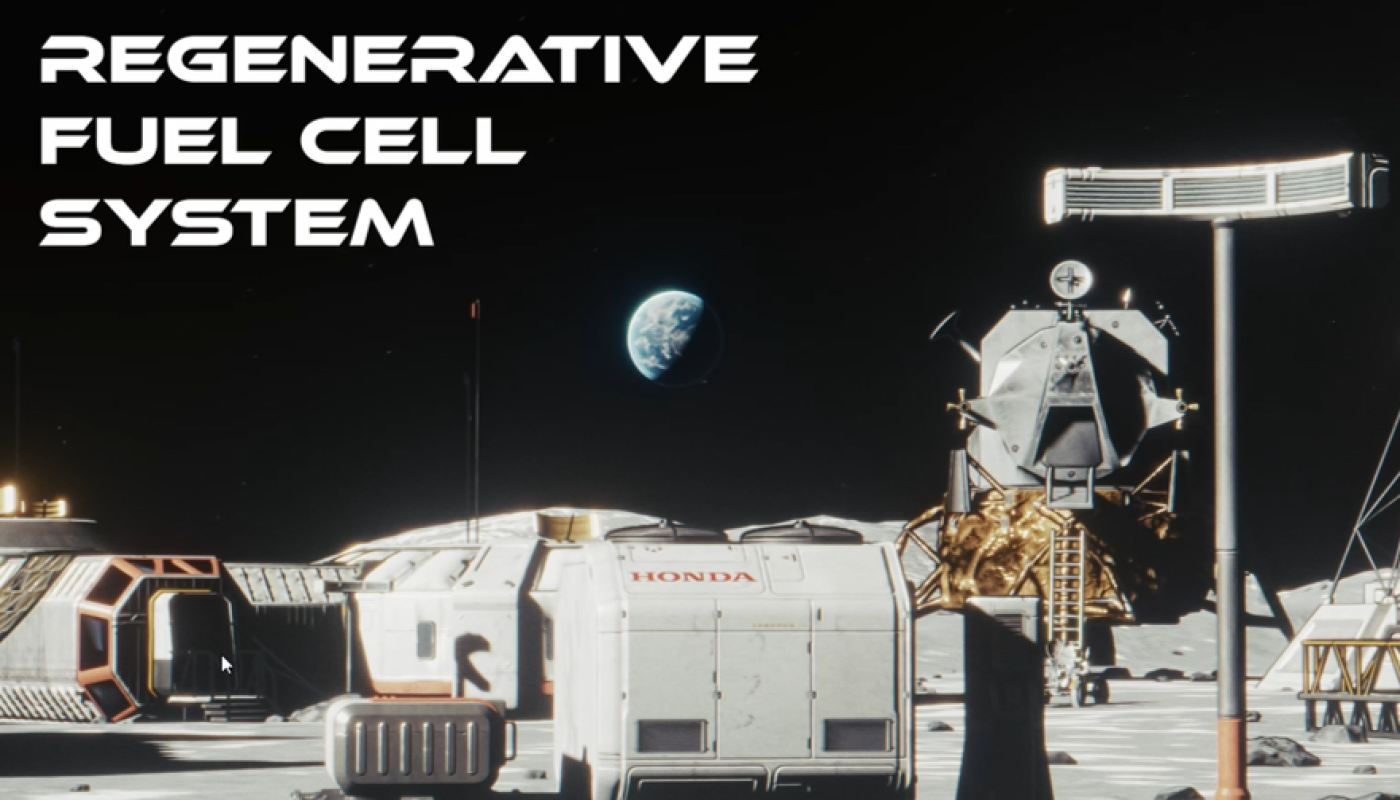

Honda has selected Sierra Space’s Dream Chaser spaceplane to transport a hydrogen fuel cell system to the ISS for testing [Payload]. Honda has put in decades of R&D investment to create a water electrolysis system that could potentially supply a future lunar base with air, electricity, and rocket fuel that could support extended stays. Dream Chaser, launched on top of a rocket, can both deliver the system to the ISS and then return it to Earth after testing is completed. It is not currently clear when the launch will occur, but the first Dream Chaser launch is expected to occur in the next few months.

An illustration of the Honda hydrogen fuel cell on a lunar base. Credit: Honda

🛰️ Technology and Infrastructure

- Space robotics firm, GITAI, has completed a concept study for a robotic arm that will be attached to the pressurized lunar rover [SpaceNews] being developed by JAXA and Toyota. The US $160,000 contract is expected to be followed by a much larger contract to build the actual robotic arm over the next five years.

- The Institute of Space and Astronautical Sciences (ISAS) (宇宙科学研究所), a division of JAXA, announced that they are working with a commercial team to develop a lightweight Mars rover delivery technology [SpaceNews] that willl utilize an inflatable aeroshell technology originally developed at Tokyo University. Dubbed the “Mars Touch Project” will be led by NeSTRA (次世代宇宙システム技術研究組合) which will oversee deployable aeroshell technology by Fujikura Aircraft (藤倉航装) and re-entry vehicle technology by ElevationSpace, and the effort will be funded by the Space Strategy Fund.

- The second ispace lunar lander mission, Hakuto-R M2, has successfully arrived in lunar orbit [SpaceNews] on May 6 in preparation for an early June landing, meeting the 7th of 10 mission milestones.

- The final H-IIA rocket will be launched by JAXA from the Tanegashima Space Center [Japan Times] no earlier than 24 June. This has been JAXA’s reliable workhorse rocket since 2001 with only one launch failure in 24 years. The 50th launch will carry the GOSAT-GW satellite to observe greenhouse gas emissions (nitrogen dioxide, carbon dioxide, and methane) as well as water vapor, rainfall, snowfall, and soil moisture. GOSAT-GW is a successor to the earlier GOSAT and GOSAT-2 and its two instruments will be capable of capturing much larger 911 km swaths of the Earth’s surface and have a more frequent revisit cadence of three days.

- JAXA presented the launch manifest for its next H3 rocket launch [YouTube]. Rocket No. 6 will fly four Space BD payloads - UnseenLab’s BRO-19, VERTECS for a consortium of universities, Bull’s HORN-L and HORN-R - as well as the 65kg PETREL for Tokyo University and a similar sized STARS-X for Shizuoka University. This will be the first launch of the Type 30S configuration, which includes a third engine on the second stage, but does not have any of the strap-on solid rocket boosters assisting the first stage. Two more major H-3 launches are expected in 2025: one to launch a new HTV-X cargo mission to the ISS and one to launch two more Michibiki satellites (QZS-5 and QZS-7) to fill out the QZSS navigation constellation.

🔭 Science

- A JAXA Exhibit at the Osaka Expo opened on April 13 [JAXA]. It’s located in the “Future Life Village” and features a Space Theater, Moon Gravity Experience, and other exhibits.

- The extended Hayabusa 2 asteroid mission has run into some problem and entered safe mode [Space.com]. Hayabusa 2 has already done yeoman’s work visiting asteroid Ryugu (竜宮) in 2018 and returning samples back to the Earth in December 2020. Since then it’s been on its way to a second asteroid, 1998 KY26. An April 2 post on X stated that the probe had gone into safe mode on Mar 21 but remained in communication.

- A research team that included CORE Corporation, ACSL, and Rakuten Group has successfully tested the new anti-spoofing capabilities that were added to the QZSS constellation in 2024. The basic GPS signal is weak and subject to both jamming and spoofing attacks. Spoofing is when a malicious actor sends a fake signal that fools a receiver into calculating a false position. The potential for positional spoofing and jamming presents a significant risk in a future world of autonomous vehicles and drone deliveries. The QZSS has added a new QZSS Navigation Message Authentication (QZNMA) service that can confirm which signals are the real ones and reject false ones.

- The Japan Atomic Energy Agency (JAEA) signed an agreement with the JAXA in March to create a specialized battery system that uses radioactive americium to create long-duration, maintenance-free batteries that can operate in the harsh lunar environment, where lunar days and nights each last 14 days and temperature can fluctuate between 120℃ during the day to -150℃ degrees at night.

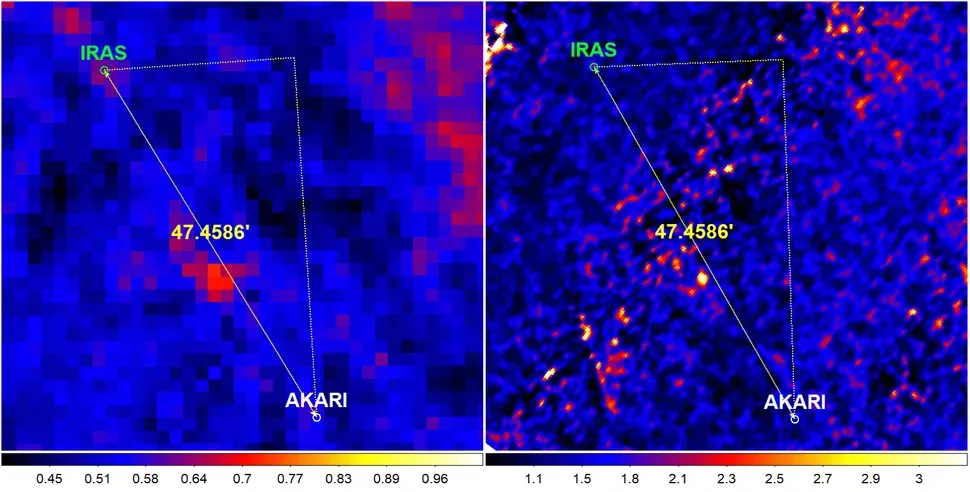

- The JAXA AKARI infrared astronomy mission operated from 2006 to 2011, but it is still yielding results (call it the long tail of open data). A Taiwanese team led by Terry Long Phan used IR data from AKARI and the earlier IRAS mission to identify the location of a potential Planet 9.

A comparison of the position of the candidate object in the IRAS data (left) and the AKARI data (right) and the distance in arcminutes between them. (Image credit: Phan et al (2025))

🗺️ International Collaborations

- ispace has agreed to collaborate with Redwire on future lunar missions [SpaceNews]. The ispace U.S. subsidiary has a NASA CLPS contract through Draper Laboratory to send a lunar landar to the dark side of the moon in 2026. Lunar missions that follow will leverage Redwire’s cameras, sensors, and other technology as well as using Redwire’s assembly and test facilities. This will be particularly convenient because ispace and Redwire are already co-located in the same Colorado location.

- GITAI has created a new U.S. subsidiary, GITAI Defense and Space, in Torrance, California focused on pursuing U.S. national security contracts. GITAI already has contracts with the U.S. government to design and build robotic arms, satellites, and rovers. U.S. DoD and NASA require ownership by U.S. citizens, so the new company will be 51% owned by a U.S. trust company and 49% by GITAI USA, which is, in turn, owned by Japanese citizens and venture capital firms.

- At the 10th Annual China Space Day (April 24), the China National Space Administration (CNSA) announced that it had accepted applications for portions of the lunar samples collected by its Chang’e-5 mission, including a Japanese research team from Osaka University as well as teams from France, Germany, UK, US, and Pakistan.

- Japan is considering joining the EU’s Horizon Europe R&D program as soon as 2026. The companies and universities in countries that participate in the program are eligible to receive grants and contracts to carry our advanced R&D and innovation activities. South Korea joined earlier this year and Singapore is also considering joining. A consortium of 11 Japanese universities proposed the initiative in February, and I think the rapid move to make it happen is a testament to the degree to which the Trump administration’s actions are shaking up technology, investment, and diplomatic priorities.

📆 Asia-Pacific Conferences & Events

This newsletter is mostly focused on Japan, but I also like to highlight events across the Asia-Pacific region. Some upcoming conferences in 2025 include:

May 2025

- Global Space Exploration Conference (GLEX) - 7 - 9 May - New Delhi, India

- GeoSpace Bharat - 14 - 16 May - Visakhapatnam, Andhra Pradesh, India

- Langkawi International Maritime and Aerospace Exhibition (LIMA) - 20 - 24 May - Subang, Selangor, Malaysia

- Australian Space Summit and Exhibition - 27 - 28 May - Sydney, Australia

- Satellite Asia 2025 - 27 - 29 May - Singapore

June 2025

- APSAT International Conference - 2 - 3 June - Jakarta, Indonesia

- International Space Summit - 3 - 5 June - Daejeon, South Korea

- International Workshop on Greenhouse Gas Measurements from Space (IWGGMS-21) - 9 - 12 June - Takamatsu Japan

- Committee on Earth Observation Satellites (CEOS) Atmospheric Composition (AC) VC-21 - 9 - 13 June - Takamatsu, Japan

- 9th Shanghai International Aerospace Technology and Equipment Exhibition - 11 - 13 June - Shanghai, China

- India Space Congress - 27 - 27 June - New Delhi, India

- UN Committee on the Peaceful Uses of Outer Space (COPUOS) 25 June - 4 July - Vienna, Austria

- 37th Space Studies Program (SSP) - 30 June - 22 Aug - Ansan, Gyeonggi, South Korea

July 2025

- 43rd Aerospace Numerical Simulation Technology Symposium - 2 - 4 July - Tokyo, Japan

- Spacetide - 7 - 10 July - Tokyo, Japan

- Committee on Earth Observation Satellites (CEOS) Working Group on Calibration & Validation (WGCV)-55 - 8 - 11 July - Hyderabad, India

- 35th International Symposium on Space Technology and Science (ISTS) & 14th Nano-Satellite Symposium (NSAT) Joint Symposium - 12 - 18 July - Asti Tokushima, Japan

- 18th Australian Space Forum - 15 - 16 July - Adelaide, South Australia, Australia

- IEEE Space - 21 - 23 July - Bengaluru, Karnataka, India

- SPEXA Space Business Exp - 30 July - 1 Aug - Tokyo, Japan

As a bonus, here are a few recordings of related seminars and events over the past few weeks:

- KibouX Commercialization - the Post-ISS Era - https://www.youtube.com/watch?v=jG-Sq_Zgk7k

- TansaX Seminar - https://www.youtube.com/watch?v=3DsQqlYMz3w

- Space Strategy Fund Year 2 Information Session - https://www.youtube.com/watch?v=tlgHMTVfksQ

- Japan-Singapore Innovation & Space Financing Workshop at GSTCE event - https://www.youtube.com/watch?v=JTIbsdtg6qE

- JAXA H3 Rocket Development Update: https://www.youtube.com/watch?v=v_4ooNyVFWs

JMoD Satellite Infrastructure Investments

Current JMoD Satellite Infrastructure

For the past 25 years, Japan’s Ministry of Defense (JMoD) (防衛省) has been gradually building out satellite infrastructure in three key areas:

- Intelligence, surveillance, and reconnaissance (ISR)

- Communications and electronic eavesdropping

- Positioning, navigation, and timing (PNT)

Until the late 1990s Japan relied entirely on U.S. defense satellite infrastructure to provide these capabilities. However, the August 1998 Taepodong incident was a watershed moment. I wrote about this a bit in JEO 2, but to briefly summarize, on 31 Aug 1998, North Korea tested the three-stage Taepodong-1 ballistic missile by launching it on a trajectory that took it right over the Japanese islands. A U.S. reconnaissance satellite detected the launch but did relay that very relevant information to the Japanese government until after the fact. The Japanese government had been concerned about DPRK missile capabilities for several years, but it had not allowed the Self-Defense Forces (SDF) (自衛隊) to build its own satellite infrastructure. Rather, JMoD was directed to use the U.S. GPS and ISR capabilities and contract with commercial firms for imagery. Since the U.S. application of Section 301 trade law caused the collapse of the domestic Japanese satellite manufacturing industry in the 1980s, this meant buying imagery from U.S. commercial firms like Digital Globe and Space Imagery (now Maxar). The so-called Taepodong Shock (テポドン・ショック) was Japan’s Sputnik moment and inspired a wholesale reexamination of both defense and space priorities. Three defense satellite programs were subsequently developed.

Intelligence, surveillance, and reconnaissance (ISR)

The blandly named Information Gathering Satellites (IGS) (情報収集衛星) would become a new constellation of synthetic aperture radar (SAR) and optical satellites that would provide surveillance and (missile launch) early warning. Starting in 2003, the IGS satellites were launched as pairs - one optical and one SAR - with capabilities improving over time. The technology initially borrowed from the civilian ALOS and JERS Earth observation satellites operated by JAXA, and they were likewise manufactured by Mitsubishi Electric. The most recent generation IGS-Optical-8 and IGS-Radar-8 were launched in 2024, and today there are eleven operational IGS satellites.

Communications and electronic eavesdropping

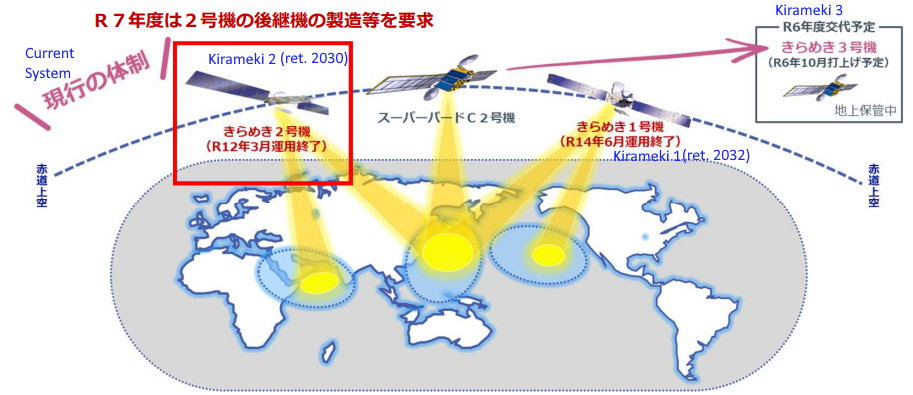

A constellation of communications and electronic eavesdropping satellites was also developed. These satellites were designed to operate in geostationary orbit with X-band communications capabilities. Rather than building, launching, and operating them directly, JMoD used a private finance initiative (PFI). A PFI is a type of public-private partnership (PPP) originally developed in the UK. Under a PFI, a private firm or consortium of firms is contracted to build, own, and operate a public service. In this case JMoD signed a contract with DSN Corporation, a joint venture of SKY Perfect JSAT, NEC, NTT Communications, and Maeda Corporation, to build and operate an X-Band satellite network for the military. The first bird, DSN-1, more commonly known as Kirameki-1 (きらめき1号機), was not a standalone satellite. Whether DSN and JMoD were in a hurry or just trying to save some money, the defense payload was added to a JSAT commercial satellite, Superbird-8. However, an overpressure accident during transportation damaged the satellite, and repairs took two years. Kirameki-1 finally went into orbit in April 2018. By that time a dedicated defense mission, Kirameki-2 (DSN-2 or きらめき2号機), had already been launched in January 2017. Kirameki-3 (きらめき3号機) was launched on an H3 rocket in November 2024. These satellites have approximately 15-year lifetimes, and Kirameki-2 is currently expected to end operations in March 2030 and Kirameki-1 in June 2032.

(https://www.japanearthobserver.com/content/images/2025/05/05-current-kirameki-config-jmod.png)

(https://www.japanearthobserver.com/content/images/2025/05/05-current-kirameki-config-jmod.png)

Current Kirameki configuration as of September 2024 (just before the Kirameki-3 launch). Credit: JMoD

Positioning, navigation, and timing (PNT)

The third constellation that arose from the Taepodong shock was the Quasi-Zenith Satellite System (QZSS) (準天頂衛星システム), a set of positioning and navigation satellites. Initially designed to augment the U.S. GPS system over the Asia-Pacific region, it may eventually be able to operate independently from the GPS. I wrote about this in depth in JEO 2, so I won’t recapitulate here. The current design for a 7-satellite constellation is almost complete. QZS-6 was launched in February 2025, and QZS-5 and QZS-7 are expected to launch later this year. While the QZSS satellites (aka Michibiki みちびき) use the core GPS signal design, they also sport augmentation signals to improve both positional accuracy, an anti-spoofing authentication service, and an emergency messaging services for disaster and crisis management. These satellites are managed directly by the Cabinet Office (内閣府) (rather than JMoD), but Japan has closely collaborated with with U.S. Dept of Defense to develop this constellation, and they clearly have dual use (civilian and military). There are plans to potentially expand the QZSS to 11 satellites, but I am not aware of a specific budget request to do this yet.

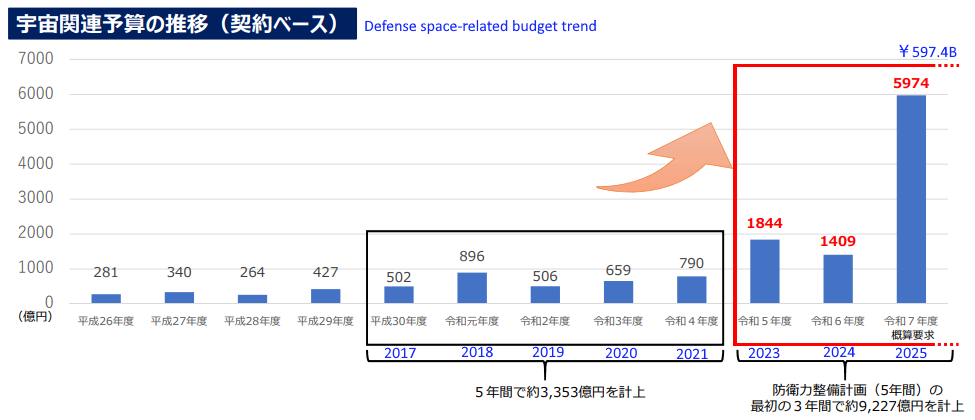

Budget Requests for Next Generation Capabilities

Based on a FY2025 budget request published in September 2024 [in Japanese], JMoD is planning four major investments in new satellite technology aimed at beefing up security, operational capabilities, and space domain awareness (SDA). This would have represented a huge increase in the space-related budget with almost JPY 600 billion. The approved budget trimmed back the request somewhat but still weighed in at JPY 550 billion (~US $3.67 billion).

Scale of increase of space-related defense budget for FY2025. Note that the approved budget was somewhat lower at about JPY 550 billion. Credit: JMoD

Some of this increase is aimed at enabling Japan to develop a dedicated Space Wing as part of the Air Self Defense Force (ASDF), but most of the increase is hardware. The major new satellite programs include:

- Protected Anti-jam Tactical SATCOM (PATS)

- Supplemental commercial LEO satellite communications

- Next generation communications satellites

- Satellite constellation development - build a new, dedicated surveillance satellite constellation centered on SAR with some supplemental optical sensors

PATS Equipment

The U.S. is leading development of a next-generation satellite-based defense communications system that will be shared by allies. Known as the Protected Anti-jam Tactical SATCOM (PATS), Japan will invest JPY 2.2 billion (~ US $14.67 million) in equipment to connect to PATS. Deployment and testing of PATS-compatible equipment is expected to run through FY2029.

Commercial LEO Satellite Communications Equipment

In order to supplement communications capacity on Maritime Self-Defense Force (MSDF) ships, JMoD will install receiver equipment that can leverage contemporary, high bandwidth, commercial LEO communications satellites. In addition, JMoD anticipates that this will enable MSDF crew to use the additional bandwidth to consume internet services and remain better connected with their families. This sounds to me like “let’s write a check to SpaceX Starlink so that our MSDF sailors can check their email and Facetime their families.” I did not see any budget line items labeled “Starlink”, but I’m pretty sure that’s what it is. There were 16 vessels equipped in FY2024, 47 more will get the equipment in FY2025, and the remainder in FY2026. At JPY 600 million (~ US $4 million) in FY2025, the quality of life improvement for sailors is probably a pretty good deal.

Beyond Kirameki for Comms

As outlined above, two of the three Kirameki X-band communications satellites have an expected end-of-life in 2030 and 2032, respectively, so JMoD thinks it is time to start designing and developing the next generation. Development of the Next Generation Defense Communications Satellite System (次期防衛通信衛星等の整備) (acronym and cute name forthcoming) is going to start this year. Survey, design, and construction of the ground segment sites and equipment will cost about JPY 550 million (~ US $3.67 million) this year and will run through JFY 2029. The satellites will be the big ticket items and have been allocated JPY $123.6 billion (~ US $824 million) in FY2025. The plan is that they will be ready by JFY 2029 for a JFY 2030 launch, testing, and operation. Will they continue the X-band geostationary template set by Kirameki? What will the constellation configuration be? Will they be compatible with Kiramekis? (I assume they won’t be tossing the shiny new Kirameki-3 satellite in the dustbin). I don’t know the answer to these questions, but if you do, drop me a line.

SAR-y Eyed Vision

The fourth investment will cost more than the other three put together by a significant margin. JMoD wants to develop a new satellite constellation for intelligence, surveillance, and reconnaissance (衛星コンステレーションの整備・運営等事業) beginning this year [h/t to Joe Morrison for the info]. In addition to the IGS constellation, JMoD already procures imagery from a range of domestic and foreign commercial SAR and optical satellite constellations for imagery, but these operators cannot always obtain images at the timing and frequency that JMoD wants. Further, there are new concerns about potential restrictions by operators or governments in a time of crisis. So-called “shutter control” was recently exercised against Ukraine by the United States, and this behavior by the U.S. has raised new concerns among U.S. allies as well as a surge of interest in “sovereign” capabilities.

JMoD will not build and operate the new constellation itself, but, rather, will use the same private finance initiative (PFI) procurement mechanism that they used for the Kirameki communications satellites. This means they will contract with a private commercial operator (or, more likely, a consortium) to build, own, and operate the constellation and necessary ground station infrastructure. JMoD will have priority access to the capabilities but the private operator will also be able to sell imagery to other clients in order to recoup costs. The FY2025 budget request was for JPY 323.2 billion, but the approved budget was reduced to JPY 283.2 billion (~ US $1.89 billion). Even with the reduction, that’s still a lot of money. For perspective, it is more than the combined market cap of the two commercial Japanese SAR companies, Synspective (JPY 129.83 billion) and iQPS (JPY 77.43 billion), combined.

There is a fairly detailed Implementation Plan (実施方針) [in Japanese] available online, and here’s what I could glean from the document. First, this will be a SAR-central constellation. SAR provides visibility under all weather and day/night conditions. Optical sensors will supplement this with high-resolution visual or multi-spectral imagery when conditions are clear. JMoD is prioritizing high revisit cadence over Japan and surrounding regions; once fully operational, at least one satellite should always have a shot at any location in the region. The successful provider will also need to develop a dedicated ground segment (専用地上施設) secured for defense-related data handling.

JMoD clearly wants a domestic, sovereign capability; all satellites must be domestically produced (国産衛星). Assuming a successful bidder will be a consortium, all members must be Japanese legal entities, including subcontractors. The lead company must have top-tier JMoD procurement credentials of rank A for manufacturing, sales, and services in the Tokyo region. Any company doing the actual satellite operation and imagery collection must have experience building and operating similar satellites and they have to be in orbit at the time of the proposal submission. This probably means Synspective, iQPS, or both will have to be part of any successful consortium. Mitsubishi Electric recently bought a stake in Synspective, and SKY Perfect JSAT was an early investor in iQPS, so that suggests the kernels of two potential consortia. The PFI procurement structure will require the team to take on significant upfront costs and risks, so the team will need substantial financial muscle to carry the investment costs until satellites are launched and operational.

The project plan anticipates a two-year deployment process across JFY 2026 and 2027, and the winning team may use foreign rideshare launch capabilities in order to meet the aggressive deployment timeline. Full constellation operation is expected by April 1, 2028 (JFY 2028) and operations to continue through at least March 2031 with an option to extend the service period after that.

The initial RFI will be released on May 27. The formal RFP will be released in July and a two-stage submission process will run through October with a final decision to be made around December 2025 and a contract expected to be in place by February 2026 for a formal April 2026 start date. Good luck to all of the folks at Synspective, iQPS, Melco, JSAT and other that will likely be burning the midnight oil over the next few months as they prepare their RFI and RFP submissions.

The United States government has directed a lot of whinging about defense cost sharing toward Europe, Japan, and others over the past couple of decades. These new JMoD investments have been in motion for at least a couple of years, but the recent tariff fracas plus U.S. behavior in Ukraine and elsewhere have likely injected new urgency into these and other defense procurement initiatives. Further, the focus on bulking up domestic design and manufacturing capacity is aimed not only at control in a crisis situation but also ensuring that Japan has one or more national champions that can be globally competitive. Unsurprisingly, both Synspective and iQPS have enjoyed a fillip to their share prices over the past month.

If you’ve made it this far, thank you for reading. Please be in touch via LinkedIn with any feedback, questions, comments, or requests for future topics. And if you have a friend or colleague that you think would enjoy JEO, please feel free to share it!

Until next time,

Robert

It has a scent,

but I can’t see

My neighbor’s plum tree.

– Miura Chora (1729 - 1780) - translated by William Scott Wilson

匂ひして

隣の梅の

見えぬかな

nioi shite

tonari no ume no

mienu kana