JEO 9 - News Roundup - 11 Feb 2026

A periodic news roundup on the space, Earth observation, and geospatial industries in Japan.

Welcome to Japan Earth Observer (JEO), a free monthly newsletter with a news roundup and one in-depth article about the space, Earth observation and geospatial industries in Japan.

A new year brings reflection on what went well, what could be improved, and how to get there. Looking back on the first year of Japan Earth Observer, I am satisfied with what I have published but unhappy with the cadence and consistency.

First, the things that brought satisfaction.

- Balancing topic diversity and focus - I think I found a good range of topics about which I’m curious and have held my attention. I have a broad range of interests and read widely, so keeping this newsletter within a bounded set of topics - space, Earth observation, and geospatial industries in Japan - was an accomplishment in itself.

- Adequate material - I found enough material on an ongoing basis to fill a newsletter on this somewhat niche topic. I aimed for monthly, but I think I now have enough sources that I could publish bi-weekly or even weekly and still have enough material.

- Longer articles - I was able to find a range of topics about which I was sufficiently interested that I could write a longer, more in-depth article.

- History + Now - I have noticed that I particularly enjoy the research and writing that combines history with contemporary events (see the most recent article on the zaibatsu, keiretsu, trading companies, and space), so I want to continue exploring that approach.

- Finding my voice - As I learn more, I am gradually developing my own opinions, and I am more willing to interject them in the newsletter. When I read other newsletters, I have found that I learn more when the authors inject their own interpretation on events in a clear way. So in JEO 7 and 8, I started writing additional notes with a “Why does this matter?” on some news notes, and I’d like to continue doing that.

- Expanding network of relationships - Writing the newsletter has enabled me to meet a bunch of people in the industry with shared interests, and this has been a source of both meaning and learning.

- Building a database of the Japanese industry landscape - As I’ve learned about all of the interesting work happening in Japan, I’ve begun to build a database of companies, government entities, academic institutions, and non-profit organizations doing related work. This meant going slower in the fall, when I was adding a lot of organizations to the database, but is now helping me research faster as it becomes more of an asset.

- Improving my Japanese skills was one of the goals - I’ve been able to use the process of assembling the newsletter as a way to continue improving my Japanese language skills in a way that is more interesting to me than conventional study. This has often meant watching of hours of JAXA news conferences, rocket launch play-by-plays, and geospatial conference proceedings on YouTube, but these have turned out to be fascinating and the the videos have proven helpful for both learning the vast amount of technical vocabulary that I haven’t yet acquired and to train my ear on a different aspect of the Japanese language than I’d previously developed. And my Anki flashcard deck has exploded in size.

On the “what could be better” side of the ledger is the cadence and consistency. I initially aimed for one newsletter per month and mostly pulled it off in the first half of the year, but the wheels fell off after that. As the year progressed, I found many more sources for news, but I did not develop an adequate set of tools to review and summarize them faster. In addition, I worked on a few longer articles in the latter half of the year that often took longer than I expected to research and write, thereby holding up the news portion such that it felt stale (at least to me) by the time it was published. This culminated with JEO 8 in early January. When printed out it was almost 60 pages and the news was mostly two months old already. I don’t think most people want a 60 page newsletter with stale news, so I’m going to be making some changes starting with this newsletter.

- Split the newsletter into two types - “News Roundups” that can be sent out more frequently and longer articles that will go out on a less frequent basis as standalone articles. My inspiration for this approach is Adam Tooze’s excellent Chartbook newsletter, which publishes “Top Links” daily and a longer “Chartbook” weekly. I don’t think I can match his output, but I’d like to aim for more frequent news versions plus less frequent longer pieces.

- Mix shorter and longer articles - For the more in-depth articles, I think I’m going to try to write a mix of shorter pieces interspersed with longer, researched articles.

So, in summary, more, but less; more newsletters, but shorter and less in each one. If you have feedback, please don’t hesitate to be in touch.

On to the news.

News & Announcements

-

The Urban Data Challenge (UDC) (アーバンデータチャレンジ) has announced the finalists for its 2025 competition. The UDC is an annual national design competition held since 2013 that promotes the use of data (primarily open, public, geospatial data), in order to solve local problems. Teams develop and submit software applications, data sets, activities, and concepts. Submissions are judged based on practical utility, completeness of the solution, degree of innovation, team diversity, duration, and likelihood of continuity. The contest has two divisions - a General Division and a Business Professional Division - each with monetary prizes for top submissions as well as special awards for projects that use GTFS transit, the Bodik data catalog, or have a social infrastructure focus.

The UDC is organized by the Association for Promotion of Infrastructure Geospatial Information Distribution (AIGID) (一般社団法人社会基盤情報流通推進協議会) in collaboration with Code for Japan (一般社団法人コード・フォー・ジャパン) and sponsorship from the Japan Construction Information Center (JACIC) (一般財団法人日本建設情報総合センター).

Each annual cycle begins with information sessions in the summer and fall, giving teams a chance to network and assemble. The submission deadline is in December and a first round of judging narrows the list to several finalists in each category. The final selection process is an event in February. This year it will be held 21 Feb at University of Tokyo's Komaba Research Campus (東京大学駒場リサーチキャンパス)

💱 Contracts and Funding

-

Synspective inked new distribution contracts with Japanese firm PASCO and Australia firm Geospatial Intelligence to broaden the availability of its SAR imagery..

-

Japanese launch startup Interstellar Technologies has closed a ¥20.1 billion (~US $130 million) Series F funding round [Interstellar] from an array of new and existing investors with a mix of debt and equity. The round was led by Woven by Toyota and included SBI Group, Nomura Real Estate Development, B Dash Venture, SMBC Edge, SMBC, Japanet Holdings, Space Frontier Fund II, and others. This round brings Interstellar's total fund-raising to ¥44.6 billion (~US $288 million). Other R&D funding has come from JAXA SBIR and Space Strategy Fund contracts. The funds will be used to continue work on the ZERO small launch vehicle currently expected to make a first launch attempt in 2027, as well as for scaling its rocket and satellite manufacturing capacity. Speaking of ZERO’s maiden flight, Interstellar recently secured three more satellite launch customers for the first flight. This expansion of the manifest for the inaugural mission underscores the growing demand for dedicated small-satellite launch services.

- Why does this matter? This represents one of the largest startup funding rounds in Japanese space industry history. From what I can tell, it’s an all-Japanese crew of investors, suggesting that while many people in the Japanese tech industry decry the paltry size of the private capital markets in Japan, when push comes to shove, the funds can come together. Nonetheless, I think that leveraging startup capital in the US, Singapore, Europe, and elsewhere would help Japanese firms scale more effectively.

-

BULL raised a seed round to support development of its space debris prevention devices [BULL], a “sail” that can be extended at the end of a satellite’s service life in order to accelerate deorbit and prevent a satellite from becoming debris. Investors included Frontier Innovations and Tokio Marine & Nichido Fire Insurance as well as debt financing from Ashikaga Bank and Sumitomo Mitsui Bank.

-

SPACE SHIFT announced an additional Series B funding [SPACE SHIFT] from NI-WA Co., Nagase & Co., and General Incorporated Association G·B.. The funds will used for R&D, overseas expansion, and further development of their AI software technology using synthetic aperture radar (SAR) centered on SAR (Synthetic Aperture Radar) for data analysis

-

Astroscale is having a pretty good run of contract wins since the new year:

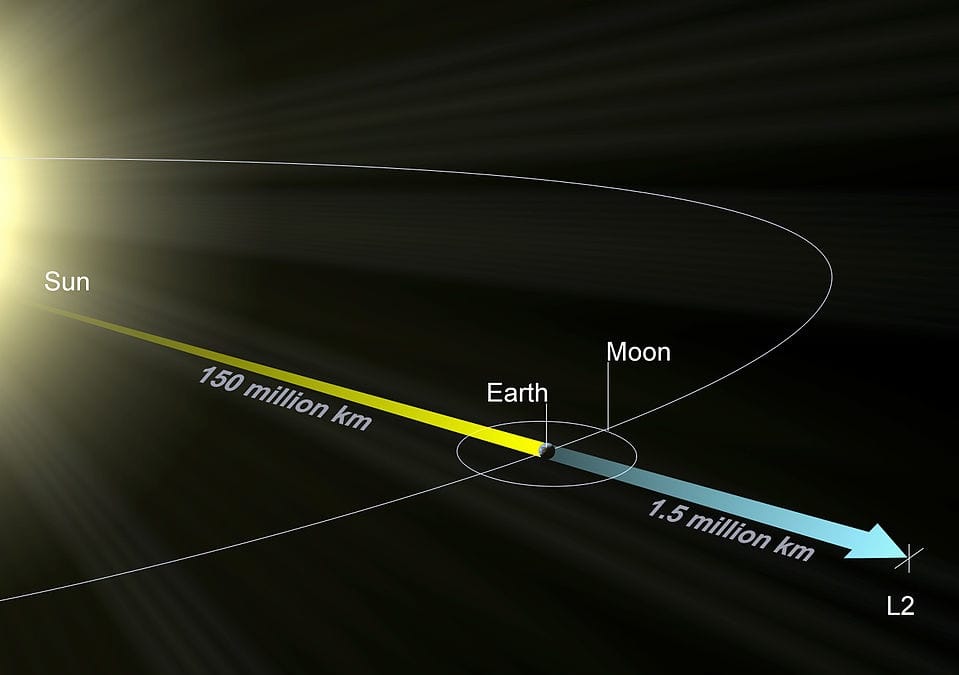

- Astroscale US has been selected by NASA to assess the ability to service the Habitable Worlds Observatory (HWO) [Astroscale]. The HWO is a next generation space telescope planned for development in the late 2030s and launch in the early 2040s. It is intended to build on the achievements of the Hubble, Webb, and soon-to-be-launched Roman space observatories and continue the search for Earth-size exoplanets in the habitable zone of their stars. The current HWO design calls for the telescope to be sited at the L2 Lagrange point (the same location as the James Webb Space Telescope) in order to provide a dark, cold, ultra-stable, gravitationally-balanced location. However, while the Hubble Space Telescope orbits close enough to the Earth that it could be serviced by the Space Shuttle or other conventional rockets, the L2 point is 1.5 million kilometers from Earth, well beyond the Moon. NASA wants to determine if there will be a way to service the telescope using robotic spacecraft, and, if so, build the serviceability into the design. To that end, they have awarded Astroscale US a three-year contract to try to figure out how to do it.

- Why does this matter? The Webb and Roman telescopes are being launched without an established ability to remotely service them The Hubble servicing missions by the Space Shuttle dramatically extended that telescope’s life and it’s still being used to do great science today. If Astroscale can develop a cost effective approach to servicing a telescope out at L2, it will substantially mitigate the risk of these exquisite and expensive machines. Astroscale probably has more experience with satellite servicing and orbital sustainability than any other company in the world, and they are a great choice for this project. However, this challenge will clearly require some serious innovation. I look forward to seeing what they come up with.

- Astroscale UK has been awarded a €399,000 contract by ESA [Innovation News] (~¥74 million) to lead the design of an In-Orbit Refurbishment and Upgrading Service (IRUS) concept to enable satellites to be upgraded, repaired, and refurbished while in orbit. It's a short, 8-month contract that presumably will be followed up with actual development, demonstrations, and testing. This Phase A engagement will enable Astroscale and partner BAE Systems to do some technical feasibility work as well as outline the commercial case for in-orbit servicing activities. This fits into ESA's Zero Debris strategy that aims to stop adding new debris by 2030 and being "space-debris neutral" by 2040 (no net new debris being added to the obits).

- Astroscale Japan won a Japan Ministry of Defense (JMoD) contract to develop a satellite gripping system for grabbing orbiting satellites under a range of conditions. This is being framed as satellite servicing and sustainability, but one could also imagine the utility of a robotic grappling arm for use against an adversary in a conflict. The ¥1 billion (~US $6.7 million) contract will run for 28 months (Dec 2025 - Mar 2028) and will result in ground-based demonstrations of the developed capabilities. This is Astroscale's second contract with JMoD (first was awarded in Feb 2025).

L2 Lagrange point diagram. Source: ESA

- Astroscale US has been selected by NASA to assess the ability to service the Habitable Worlds Observatory (HWO) [Astroscale]. The HWO is a next generation space telescope planned for development in the late 2030s and launch in the early 2040s. It is intended to build on the achievements of the Hubble, Webb, and soon-to-be-launched Roman space observatories and continue the search for Earth-size exoplanets in the habitable zone of their stars. The current HWO design calls for the telescope to be sited at the L2 Lagrange point (the same location as the James Webb Space Telescope) in order to provide a dark, cold, ultra-stable, gravitationally-balanced location. However, while the Hubble Space Telescope orbits close enough to the Earth that it could be serviced by the Space Shuttle or other conventional rockets, the L2 point is 1.5 million kilometers from Earth, well beyond the Moon. NASA wants to determine if there will be a way to service the telescope using robotic spacecraft, and, if so, build the serviceability into the design. To that end, they have awarded Astroscale US a three-year contract to try to figure out how to do it.

-

ArkEdge Space and Seiren signed an MOU to strengthen cooperation toward mass production of ultra-small satellites, accelerating constellation business development through advanced manufacturing partnerships. The partnership aims to leverage Seiren's manufacturing capabilities to scale up satellite production for ArkEdge Space's planned constellation deployments.

-

Orbital Lasers has been awarded a contract by the Japan Ministry of Defense (JMoD) to develop and prototype space-based laser technology for ranging and measurement purposes. The ¥2.05 million (~US $13,700). It’s a small contract, but it’s a young company and must feel like a vote of confidence.

-

Axelspace signed several agreements including:

- A partnership agreement with South Korea's Nara Space Technology, to distribute the imagery it collects via its Grus satellites. Nara Space both builds satellites and operates a data analytics platform, EarthPaper, through which Axelspace’s imagery will be distributed.

- A multi-launch agreement with global launch integrator Exolaunch, securing future deployment capacity for their constellation expansion.

- Pale Blue signed a contract with Axelspace to fly and test its advanced PBH-100 electric Hall thruster propulsion system on the AxelLiner Laboratory platform scheduled for launch in 2027. The PBH-100 is designed for 50–200 kg class satellites, offering a balance of high thrust and high specific impulse with a significantly reduced startup time compared to conventional Hall thrusters.

-

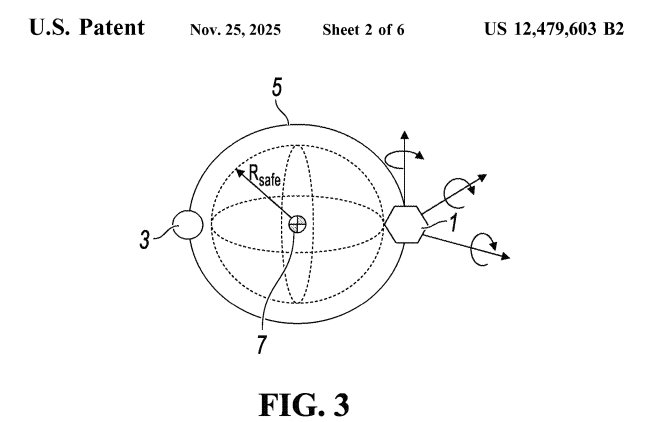

Astroscale has secured a new U.S. patent (No. 12,479,603 B2) for an innovative, low-fuel method for docking and servicing satellites that are rotating uncontrollably [SatNews]. Approaching a chaotically tumbling spacecraft is inherently risky as uncontrolled contact can result in impacts and fragmentation. Under the new patent, an approaching spacecraft can use internal weights to shift its center of mass (act as a countermass) and generate inertia to approach without need for contact or chemical rocket thrust. Once the servicing satellite has synchronized its rotation with the client satellite, it can be captured by a robotic arm or other device with zero relative rotational velocity. Once captured, stabilized and secured, the client satellite can be serviced, including refueling, repair, orbital transfer, de-orbit, or maintenance.

- Why does this matter? This is Astroscale's second patent in a few months. In August it was awarded a patent for an innovative method to de-orbit satellites through the use of “servicer” and “shepherd” vehicles. Patents represent a short-term monopoly during which time a firm can leverage the technology to build competitive advantage. If another firm wants to use Astroscale’s approach, they will have to partner or license the technology from them.

Diagram from Astroscale patent award. Source: U.S. Patent Office No. 12,479,603 B2

- Why does this matter? This is Astroscale's second patent in a few months. In August it was awarded a patent for an innovative method to de-orbit satellites through the use of “servicer” and “shepherd” vehicles. Patents represent a short-term monopoly during which time a firm can leverage the technology to build competitive advantage. If another firm wants to use Astroscale’s approach, they will have to partner or license the technology from them.

-

Mitsubishi Corporation (三菱商事株式会社) has expanded its partnership with Starlab Space by increasing its investment, becoming a major customer by pre-purchasing payload capacity on the future space station, and joining the Board of Directors. Mitsubishi Corp (not to be confused with a dozen or more other related companies with "Mitsubishi" in their names) is a trading company. Trading companies (sōgō shōsha 総合商社) are a uniquely Japanese corporation that originally arose in the late 19th century and bear similarities to firms like Berkshire-Hathaway (which owns significant shares in five Japanese trading companies) or the Dutch/English East India companies. They serve as import/export trading hubs on behalf of other Japanese companies as well as investors and business operators in a wide array of sectors.

- I wrote at length in JEO 8 about the trading companies and their interest in commercial space station startups. Mitsubishi was already heavily invested in Starlab Space and this represents them doubling down on that bet. Starlab won't be launching this year, but their first module will face a Critical Design Review (CDR), and a full-scale mockup will be assembled in Houston at Johnson Space Center in order to test human factors design and operations.

-

Sumitomo Mitsui Trust Bank (SMTB) is also making an investment in Starlab joining joining Mitsubishi Corp. (see above), Voyager Technologies, Palantir, MDA Space, Airbus, and Space Application Services.

-

Sojitz Corporation (another Japanese trading company) signed an agreement with Australian launch provider Gilmour Space Technologies to explore satellite and launch service opportunities. The partnership aims to combine Gilmour’s sovereign Eris rocket launch capabilities with Sojitz’s global aerospace network to advance space activities across the Asia-Pacific region. This move aligns with Sojitz's strategic focus on expanding its presence in the growing private launch sector. Gilmour has followed up the Sojitz agreement with a major Series E private equity investment of AU $217 million (~US$145 million) to fund and scale it’s operations.

-

MJOLNIR SPACEWORKS was selected for Year 2 funding under JAXA's Space Strategic Fund (宇宙戦略基金) totaling ¥1.8 billion (~US $12 million ) over four years to carry out R&D aimed at mass production of its ultra-lightweight rocket fuel storage systems. Mjolnir has been developing a hybrid plastic polymer/liquid oxidizer rocket engine as well as weldless field tanks. This R&D support will build on that work and, from JAXA’s perspective, is aimed at supporting advances in rocket components that contribute to high-frequency launches; JAXA wants to have at least 30 launches per year by the early 2030s.

-

ispace, Japan Airlines (JAL), JAL Engineering (JALEC), and JALUX signed an agreement to collaborate on "building transportation systems and infrastructure supporting sustainable lunar surface activities.” The partnership aims to apply JAL and JALEC's maintenance technology, air traffic control, and flight operation management knowledge cultivated in aviation to ispace's lunar landers and related facilities developing systems and infrastructure supporting future lunar habitats and high-frequency spacecraft takeoffs and landings.

- My take: I know everyone and their brother is trying to get back to the moon but applying Japan Airline’s expertise is air traffic control and high frequency takeoffs and landings feels like folks are getting rather out over their skis on the lunar travel biz.

-

Ispace also signed a contracts with

- JAXA to develop electric pump systems for lunar lander propellant systems [ispace]. The R&D is aimed at reducing the weight of the overall propulsion system while minimizing power consumption during flight. The study will build on ispace's experience on Missions 1 and 2.

- A strategic partnership MOU with Kurita Water Industries (栗田工業株式会社) for water resource development on the lunar surface [ispace]. This follows Kurita's March 2025 payload transport agreement and October 2025 investment in ispace. The collaboration combines Kurita's water treatment technology and knowledge with ispace's commercial lunar exploration and transportation service.

-

Agriculture data analytics firm Sagri received Japan patent No. 7761891 for an innovative process they have developed for estimating greenhouse gas (GHG) emissions from farmland using satellite EO data, and the proposal of paddy field management improvements that reduce emissions. The new technology has been integrated into their SagriVision product being used in the Philippines, Vietnam, and Cambodia with the aim of earning carbon credits.

-

Space One has scheduled the third launch attempt of its solid-fuel KAIROS rocket from Spaceport Kii in Wakayama Prefecture on 25 Feb 2026. The KAIROS rocket has already failed twice before in March and December 2024, so a lot is riding on this launch for Space One and its investors as well as Spaceport Kii, the first private spaceport in Japan. Further, KAIROS No. 3 is carrying five satellites from Taiwan's TASA space agency, Terra Space, Space Cubics, ArkEdge Space, and HErO, a satellite developed by Tokyo middle school and high school students.

- Why does this matter? While Rocket Lab has dominated the small launch vehicle market over the past few years, as it moves upmarket with its medium-lift Neutron rocket, several competitors are vying for the small payload market, and Space One has a window of opportunity to establish itself ahead of its small launch competitors.

KAIROS rocket lifting off from Spaceport KIi. Source: Space One

- Why does this matter? While Rocket Lab has dominated the small launch vehicle market over the past few years, as it moves upmarket with its medium-lift Neutron rocket, several competitors are vying for the small payload market, and Space One has a window of opportunity to establish itself ahead of its small launch competitors.

-

Synspective and GMO Cybersecurity by Ierae are launching a joint R&D effort on satellite cybersecurity [SatNews]. GMO Cybersecurity is a subsidiary of GMO Internet Group and is a leading cybersecurity professional services firm in Japan and claims to have the largest team of white-hack hackers in the country. They provide services to corporations and governments such as penetration testing, security assessment, incident response, consulting, training, and cyber attack defense. They will be applying their experience with terrestrial cybersecurity to identify threats and countermeasures for satellite constellations. The goal of the joint R&D effort will be a standardized framework for security evaluation during the satellite design and development process.

- Why does this matter? JAXA and JMoD have experienced several high profile security incidents in recent years. As Synspective, iQPS, AxelSpace, and other startups become an increasing source of defense intelligence, they will need to give much more consideration to cyberdefenses.

-

iQPS has converted from a standalone company to a holding company structure (in Japanese). As a consequence, its stock ticker has changed from TYO: 5595 to TYO: 464A and its legal name has changed from “QPS Research Institute Inc.” (QPS研究所) to “QPS Holdings, Inc.” (QPSホールディングス) with QPS Research Institute now a subsidiary fo the holding company.

- Why does this matter? This won’t mean much for current shareholders - it’s a 1:1 share swap. However, many companies find a holding company (under which there might be multiple operating companies) to be a more flexible structure. It can simplify spinoff of subsidiaries, acquisitions, international offices, and joint ventures. It can also help with risk management by isolating the high-risk satellite launch and operations business from other corporate assets. One of its early major investors, SKY Perfect JSAT, has a similar holding company structure, though, ironically, it is planning to unwind the holding company structure in 2026. We can probably anticipate acquisitions, joint ventures, or spinoff of new business units in the coming year.

-

SkyPerfect JSAT has signed a contract with SpaceX to launch communications satellites [JSAT] JSAT-31 and JSAT-32. This adds to a previous contract to launch Superbird-9, with the three satellites to be launched in 2027 and 2028 in order to provide communications coverage to Japan, East Asia, SE Asia, and Oceania -

-

IHI signed a contract with the Finnish SAR satellite company, ICEYE [Nikkei Asia], to provide a 24-satellite constellation by FY 2029. ICEYE will manufacture the constellation in Japan and will initially deliver four satellites that will launch in FY 2026. Based on performance, IHI has the option to purchase 20 more. The initial ICEYE purchase is part of a much broader constellation that IHI is building to include 100 satellites by 2030.

-

Toyota Ventures and Woven Capital joined a US $510 million Series D investment round in Stoke Space [Payload], a U.S. rocket developer, to support development of its Nova rocket and launch facilities at LC14 in Cape Canaveral Space Force Station in Florida.

-

ElevationSpace and Axiom Space signed a contract to provide a returnable reentry capsule [Nikkei Asia]. Axiom is one of the leading efforts to develop a commercial space station [JEO 8] in anticipation of the ISS’s end in 2030. In the meantime, Axiom will launch a spacecraft that will dock with the ISS in 2027. The ElevationSpace Aoba re-entry capsule will return materials to Earth while refining its technology for precision landing. ElevationSpace’s Aoba spacecraft includes a re-entry capsule, an engine, a power supply, and control systems. ElevationSpace’s re-entry capsules are based on a design developed by aerospace engineer Yoshida Kazuo at Tohoku University. Yoshida has major street-cred as he also worked on the Japanese asteroid probe Hayabusa.

- Why does this matter? Being able to bring back material developed in low Earth orbit is a key element of making commercial space stations financially viable. Axiom wants to manufacture semiconductors and pharmaceuticals in orbit and then return them economically to Earth. ElevationSpace has the necessary tech to get the material back safely.

ElevationSpace re-entry capsule. Source: ElevationSpace

- Why does this matter? Being able to bring back material developed in low Earth orbit is a key element of making commercial space stations financially viable. Axiom wants to manufacture semiconductors and pharmaceuticals in orbit and then return them economically to Earth. ElevationSpace has the necessary tech to get the material back safely.

-

Artiza Networks has agreed to distribute Square Peg Communications’ RLS-2100 Radio Link Simulator in the Japanese market [SatNews]. The RLS-2100 is used by satellite manufactures, ground stations operators, and integrators to simulate satellite communications environments in a lab setting prior to launch. Manufacturers and operators can do integration testing on the ground and avoid expensive orbital tests.

🛰️ Technology and Infrastructure

-

JAXA has delayed the launch of navigation satellite Michibiki 7 (QZS-7). The launch was scheduled for Feb 2 from Tanegashima on an H3 rocket, but the second stage failure of the last H3 rocket on 22 December has led to an investigation that has suspended future H3 launches. The failed launch in December was also a navigation satellite, Michibiki 5 (QZS-5), and the combination of QZS-5 and QZS-7 would have completed Japan’s QZSS navigation system.

- Why does this matter? This is a significant setback for JAXA, Mitsubishi Heavy Industries (三菱重工業株式会社), Mitsubishi Electric (三菱電機株式会社), and their partners. Not only was QZS-5 an expensive satellite, its loss delays the completion of the 7-satellite configuration of the QZSS [JEO] that Japan needs to be able to have a higher accuracy and standalone global navigation system. It is also a setback for the H3 rocket, which, after an initial failure, has had an otherwise successful launch record. The initial reports are that when the payload fairing separated, it impacted both the satellite attachment point, prematurely releasing the satellite, and damaged fuel pipes on the second stage [Nippon.com]. It is unclear how long it will take Mitsubishi Electric to manufacture a new satellite to replace the one that was lost, but it will be even more important for JAXA and MHI to return the H3 rocket to service. In addition to QZS-7 and at least one HTV-X cargo trip to the ISS, Japan is planning a high profile Martian Moons eXploration (MMX) mission in 2026.

-

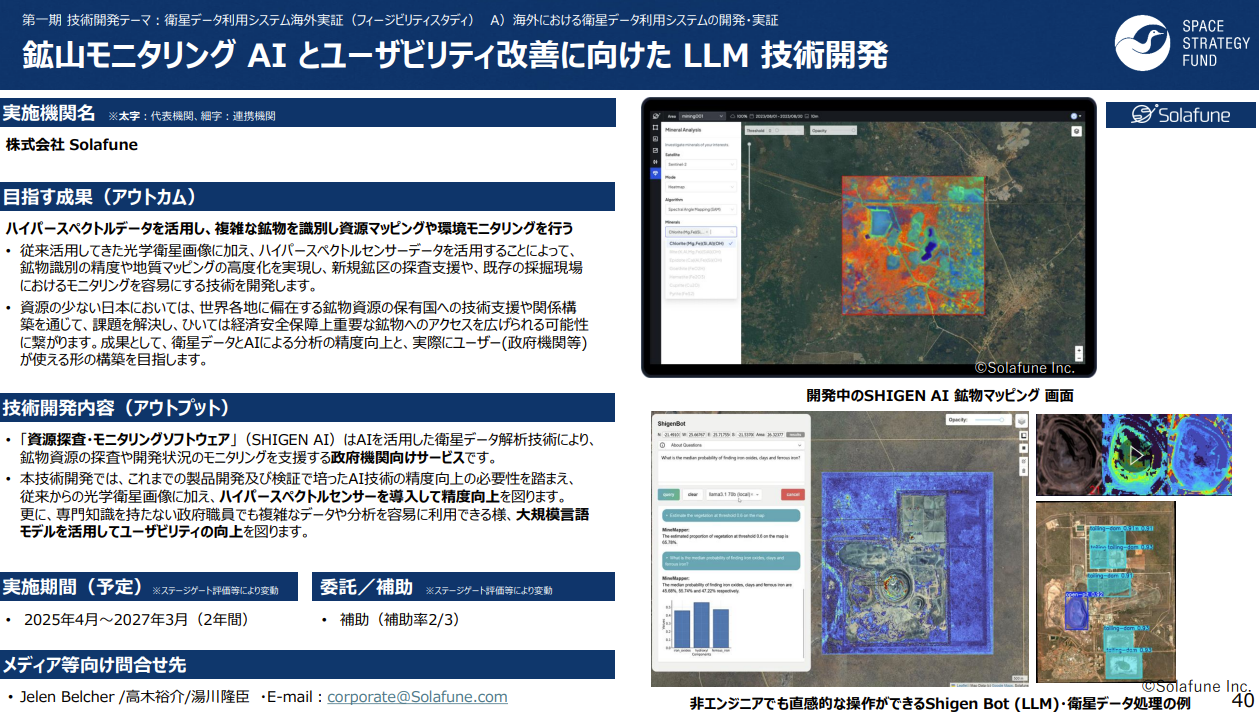

The JAXA Space Strategy Fund has released a collection of one-page summaries of Year 1 projects supported by the Fund. It's a lot of slides, but it’s a pretty great overview of how JAXA of the range of technologies being targeted for research and development.

A page from the Japan Space Strategy Fund Year 1 showcase. Source: JAXA -

Space Compass and Hellas Sat signed an MOU to support connections between their inter-satellite optical communication networks. Space Compass is a joint venture of SKY Perfect JSAT and NTT aimed at developing an on-orbit, high-capacity optical communication network and computing infrastructure in space. By agreeing to interconnect with the European satellite operator, they are laying the groundwork for a future interoperable data relay infrastructure in orbit. This type of high-speed network will be necessary to support future Earth observation applications.

- Why does this matter? As larger constellations of EO satellites capture higher resolution imagery, their downlink capacity to the Earth becomes more complex. By linking satellites together via high-speed laser networks, the constellations will be better able to align data downlink with ground station availability. But this type of interconnectivity will require protocols and standards between both friendly and competitive networks - you could think of it as a new internet for on-orbit connectivity. This agreement is an important step that will need to be followed by dozens more in order to make an interoperable, laser-linked network in space.

-

Space BD had successfully integrated and supported two launches:

- CoRAL satellite, a 2U CubeSat for Sapienza University of Rome and Thales Alenia Space Italia. CoRAL is a technology demonstrator for IoT inter-satellite communication and radio-frequency interference (RFI) monitoring.

- Ten satellites for ArkEdge Space and other companies on the SpaceX Transporter-15 rideshare mission [Space BD]. Of the ten, three were ultra-small ArkEdge satellites [ArkEdge] (AE5Ra, AE5Rb, AE5Rc) brought the total AE series constellation to 12 satellites, with 9 satellites becoming operational in the past year.

-

JAXA’s contract with Rocket Lab saw the successful launch of the Rapid Innovative Satellite Technology Demonstration-4 (RAISE-4) satellite on an Electron rocket. The RAISE series of missions serves as a testbed for validating new satellite components, subsystems, and operational concepts that will inform the design of future Japanese spacecraft. RAISE-4 carries sixteen experiments - eight cubesats and eight component subsystems - all of which were confirmed operational following launch [JAXA].

-

IHI and IHI Aerospace also had a payload, the compact hyperspectral satellite IHI-SAT2 [IHI], on SpaceX's Transporter-15 rocket. The 6U satellite has a three-year planned lifetime, during which it will acquire hyperspectral satellite imagery. Hyperspectral imagery can capture information in broader and more detailed wavelength bands than conventional optical satellite images, enabling wide-area and high-precision analysis of forest tree species, growth conditions, and disease indicators. IHI plans to use the satellite's imagery for forest management and technology advancement through the joint venture NeXT FOREST established with Sumitomo Forestry.

-

Reusable rocket developer Innovative Space Carrier (ISC) announced the cancellation of its ASCA 1.0 initiative to carry out takeoff and landing tests in the United States [ISC] due to low likelihood of obtaining regulatory approval by Q1 2026. Instead, the company will conduct domestic takeoff and landing demonstrations followed by launch demonstrations targeting fiscal year 2027 and development of a rocket and satellite launch demonstration using a domestically developed rocket engine from Hokkaido Spaceport (HOSPO) by March 2028. This is a significant shift in ISC’s strategy. In order to reduce risks and accelerate development of its reusable rocket system, in April 2024, ISC signed a collaboration agreement with U.S. rocket engine developer Ursa Major Technologies and launched the ASCA 1.0 project to develop a reusable rocket system [ISC] using UM's Hadley engines.

In the United States, rocket engine technology is generally subject to restrictions as a sensitive technology. But ISC obtained approval from the U.S. government, signed a Technical Assistance Agreement (TAA) with Ursa Major, and was able to import the Hadley engine control computer in order to develop the propulsion and electrical subsystems domestically. The first vertical takeoff and landing test was announced for May 2025. ISC signed a lease with Spaceport America to conduct the tests in the United States and attempted to receive permission from the FAA. However, slow FAA processes and the government shutdown meant that the test was unlikely to occur anytime soon. So ISC is calling an audible. Going forward, they will do their rocket testing with Asahi Kasei at their test facility Takashima City, Shiga Prefecture.

- Why does this matter? Space business entrepreneurs in the United States level a lot of complaints about the slow, cumbersome regulatory processes at the FAA, FCC, Dept of Commerce, and other regulatory agencies, but clearly they are not the only ones affected. This is a scenario in which a foreign company has licensed U.S. technology and then invested in carrying out testing at a U.S. spaceport, but they can’t get the necessary approvals in a timely manner, so they are throwing up their hands. There are currently bills in Congress aimed at streamlining approval processes (see SPACE Act of 2025 - H.R.3424 and the Space Infrastructure Act - H.R.1154), but the current Congress is hardly a hallmark of streamlined processes, so forecasts of progress remain murky.

-

SPACE COTAN’s Hokkaido Spaceport (HOSPO) is attracting new investments as it aims to create a space-focused innovation cluster around the spaceport and nearby town of Taiki.

- In July, it hosted the first suborbital launch of a non-Japanese rocket developed by a Taiwanese firm, TiSpace

- The Hokkaido Space Summit in October attracted 62 sponsors.

- SPACE COTAN and Mitsui & Co. (三井物産) signed an MOU, marking the engagement by one of Japan's major trading companies with domestic spaceport development. The partnership signals growing commercial interest in Hokkaido Spaceport's infrastructure and potential for trading house involvement in space logistics and supply chain development.

- SPACE COTAN, Sangikyo and Sangikyo EOS signed an agreement to develop satellite ground station infrastructure to support the commercial phase of operation at the spaceport.

-

L3Harris has completed a critical design review for sensors that will be launched on the Himwari-10 weather satellite [SatNews]. The new advanced imager will build on the success of Himawari-9 by adding two new spectral bands to improve water vapor measurement and seven others for enhanced resolution. In addition to Himawari 8/9, the L3Harris Advanced Baseline Imager (ABI) is the same primary payload as the U.S. NOAA GOES-R series (GOES-16, -17, -18, and -19) and Korea's GEO-KOMPSAT-2A. The newest generation of the ABI has 12 spectral bands, rather than 4, 4x the spatial resolution, and 5x the temporal coverage.

- Why does this matter? The fact that a single supplier, L3Harris, supplies the imager for an entire generation of advanced weather satellites could potentially be a vulnerability, but it means that the weather data collected from East Asia to the Atlantic Ocean can be integrated seamlessly. L3Harris is also clearly not resting on its laurels as it continues to make significant advances in capabilities.

🔭 Science

- Researchers at Nagoya University using data from JAXA’s Arase satellite have reported detecting an enormous “plasmasphere compression” during the Gannon solar storm in May 2024. The plasmasphere is a layer of cold electrically charged particles surrounding the Earth and rotating in conjunction with the Earth’s magnetic field. In many cases, solar storms cause the Earth’s atmosphere to swell, increasing drag on satellites in low Earth orbit (LEO). However, when the sun releases a particularly powerful Coronal Mass Ejection (CME) toward the Earth’s magnetic field, it impacts the plasmasphere and the magnetosphere. The Nagoya researchers were looking at how the plasmasphere and ionosphere reacted during extreme space weather events. Gannon was a particularly strong geomagnetic storm, and they found that it compressed the Earth’s magnetic field and dragged the plasmasphere in toward the planet. The plasmasphere is usually about 44,000 km above the Earth’s surface (beyond the 36,000km orbit of typical geostationary satellites like weather and GPS satellites) but the geomagnetic storm compressed it by 80% to only 9,600km and the field took four days to recover. Understanding this phenomenon helps satellite operators protect critical communications and navigation infrastructure.

🗺️ International Collaborations

-

At a summit in Tokyo on 16 Jan, Japanese Prime Minister Takaichi Sanae and Italian Prime Minister Giorgia Meloni signed an agreement to cooperate [Nikkei Asia] on removing space debris, collaborate on satellite and launch technology, collaborate on supporting the Global South and disaster monitoring and response. The two nations will establish what they are calling a "space consultation framework" with the first formal talks to be held in Japan in June. As part of the summit, the two countries agreed to upgrade their bilateral relationship to a "special strategic partnership." The Japanese and Italian militaries already have mutual goods and services arrangements, carry out joint exercises, and are working with the UK on a sixth-generation fighter jet.

- Why does this matter? Both Japan and Italy are keen to develop their domestic space industries. The two space agencies, JAXA and the Italian Space Agency (ASI), already have a "memorandum of cooperation" and both countries are signatories to the U.S.-led Artemis Accords. With the U.S. defunding USAID and closing the NASA SERVIR program, China is advancing its efforts to use space-led diplomacy to court influence. The Italy-Japan agreement can be seen as both supporting domestic economic development and as filling the vacuum left by the U.S. abandonment of similar diplomatic efforts.

-

ispace is going to collaborate with Telespazio on development of the European Space Agency's Project Moonlight [ispace]. Telespazio, a joint venture of Leonardo and Thales, is the prime contractor selected by the ESA to develop the Lunar Communications and Navigation Services (LCNS) (aka Project Moonlight), a five-satellite constellation that will provide navigation and communications services from lunar orbit. Just as we have built dense networks of satellites that provide location, navigation, and communications services for the Earth, future exploration of the lunar surface will require similar support infrastructure. ispace has already demonstrated its ability to launch spacecraft into lunar orbit through trips in 2023 and 2025. This new collaboration will evaluate ispace's lunar transportation capabilities as well as explore models for using the comms and nav services Moonlight will make possible.

Image of the ispace orbital transfer vehicle (OTV) delivering a satellite to lunar orbit. Credit: ispace -

ispace is spinning up a new subsidiary in Saudi Arabia. This will be ispace's fourth outpost, joining subsidiaries in the EU (Luxembourg) and the U.S. (Denver). ispace had signed a research collaboration MOU with King Fahd University of Petroleum and Minerals (KFUPM).

-

Congratulations to Suwa Makoto for his selection as an astronaut for a likely mission to the ISS in 2027. Suwa has a degree in Earth science from the University of Tokyo as well as a graduate degree from Princeton and climate science research experience in the U.S. He has also done stints as an overseas volunteer in Rwanda for JICA, at the United Nations World Meteorological Organization (WMO), and the World Bank. In addition to the ISS trip, he also has a shot at a future Artemis mission to the Moon.

- JAXA Press Conference video (Japanese)

- NHK article and video (English)

Suwa-san is going to space. Source: JAXA

📆 Asia-Pacific Conferences & Events

This newsletter is mostly focused on Japan, but I also like to highlight events across the Asia-Pacific region. Some upcoming conferences in 2025 include:

February 2026

- OSM Mapper's Summit - 1 Feb - Osaka, Japan

- Space Summit 2026 @ Singapore Airshow - 7-8 Feb - Singapore

- Urban Data Challenge 2025 Final - 21 Feb - University of Tokyo, Meguro,Tokyo

- National Space Science Symposium - 23 - 27 Feb - Shillong, India

- Spacetide/Keio University Special Workshop “Introduction to the Space Business” (「宇宙ビジネス入門」特別公開講座) - 22 Feb, 8 Mar, 22 Mar - Keio University Mita Campus, Minato, Tokyo, Japan

March 2026

- 65th JSASS Aviation Engine and Space Propulsion Conference - 9 - 11 Mar - Beppu, Oita, Japan

- Convergence India Expo - 23 - 25 Mar - New Delhi, India

- Space Technology Conference (STC) - 31 Mar - 1 Apr - Tashkent, Uzbekistan

- GEO Connect Asia 2026 - 31 Mar - 1 Apr - Singapore

- Committee on Earth Observation Satellites (CEOS) Disaster and Information Services Working Group Meetings - 16 - 20 Mar - Dehradun, Uttarakhand,India

April 2026

- 57th Japan Society for Aeronautical and Space Sciences (JSASS) Annual Lectures (日本航空宇宙学会) - 15 - 17 April - Osaka University Toyonaka Campus, Osaka, Japan

- International Conference on Spacecraft Mission Operations (SMOPS) - 8-10 Apr - Bengaluru, India

- International Conference on Advances in Aerospace and Energy Systems (IAES-2026) - 16-18 Apr - Mahendragiri, Tamil Nadu, India

Recent videos

- International Space Exploration Symposium - 15 Jan 2026 [Japanese]

- Astronaut Yui Kimiya Post-Landing Press Conference - 4 Feb 2026 [Japanese]

If you’ve made it this far, thank you for reading. Please be in touch via LinkedIn with any feedback, questions, comments, or requests for future topics. And if you have a friend or colleague that you think would enjoy JEO, please share it!

Until next time,

Robert

A winter day

on horseback,

even my shadow is frozen.

– Matsuo Bashō (1644–1694) - translated by me

冬の日や

馬上に氷る

影法師

Fuyu no hi ya

bajō ni kōru

kagebōshi